How consumer priorities and the dynamics of the fashion system have changed after the pandemic

It is now no news that the Covid-19 pandemic that broke out in early 2020 has forced the entire world to change methods and priorities. Everyone, from companies to consumers, has had to adapt to an unexpected new reality.

Among the various stakeholders affected by this health, economic and social crisis, the fashion industry has faced the need to find a balance between business survival and growth and the changing attitudes of the new consumer.

Among the various phenomena concerning this industry exploded or accelerated by the pandemic, the resale market is one of the most relevant.

According to the Resale Report 2021 conducted by ThredUp, 33 million consumers purchased second-hand clothing for the first time in 2020; moreover, 76% of these consumers expect to increase their spending on used clothing in the next 5 years. The resale market is currently worth $15 billion but is expected to grow 11 times faster than the entire retail industry.

This research, conducted by Carlotta Conti, aims to investigate the main drivers of choice of young and future consumers of the fashion industry and analyze the actual spread of buying habits and sales of vintage and second-hand. Therefore, 8 in-depth interviews were conducted whose results have provided the elements to structure the questionnaire for quantitative analysis. The survey was administered to 250 users whose responses were analyzed using SPSS software.

The questionnaire was addressed to Italian boys and girls aged between 20 and 35 years. The majority of the sample was women (72%), people with a university degree (61%), and mainly from Northern Italy.

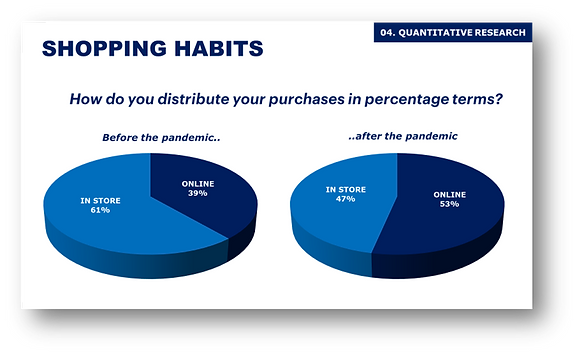

In terms of shopping habits, 63% of the sample say they have decreased their spending on clothing, while 25% of respondents only started using the online channel for clothing purchases with the advent of the pandemic.

After the section on buying habits, the questionnaire asks a series of questions regarding sustainability and buying or selling vintage and second-hand.

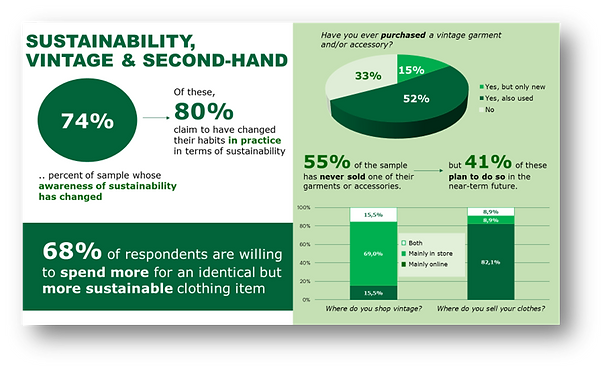

74% of respondents claim to have changed their awareness in terms of sustainability, and the majority of the sample say they are willing to pay a higher price for a more sustainable garment than an identical one in terms of quality.

The purchase of vintage is quite widespread among respondents: in fact, 67% of the sample has at least once purchased a vintage garment or accessory, while, on the contrary, the majority of respondents have never sold their clothing or accessory. The channels used to buy and sell vintage and second-hand are significantly different: if the majority of vintage purchases occur in physical stores (69%), almost all (82.1%) sales of own garments or accessories take place through the many online platforms.

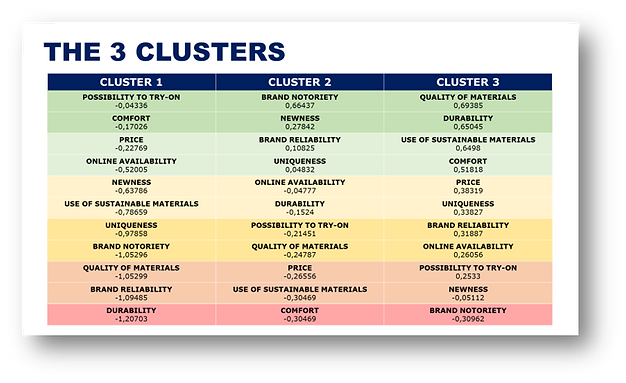

After analyzing the individual variables, a cluster analysis was conducted with the help of SPSS software based on the answers to the question: “Rate on a scale of 1 to 7 how the importance of the following factors has changed in the choice of an item of clothing compared to the pre-pandemic period”.

The factors taken into consideration are as follows: Quality of materials, Comfort, Brand reliability, Price, Use of Sustainable Materials, Durability, Newness, Possibility to try-on, Brand notoriety, Online availability, Uniqueness.

The Cluster Analysis for non-hierarchical homogeneity allowed the creation of 3 different clusters through the application of the k-means method, respecting the following criteria:

- No cluster has a small number of observations or an excessively high number of observations, ensuring homogeneity

- All variables have a significant F-test

- The actual identified characteristics of the final centres.

Once obtained, the clusters were saved within the dataset as a new variable. In this way it was possible to cross-reference the three profiles with other variables within the dataset.

From the characteristics of each group, each cluster was assigned a name to represent them:

- Cluster 1: “The Practicals”: Generally uninterested, they give importance to purely “concrete” factors such as the possibility to try on a garment and its price. They don’t care if it is durable and high quality, but rather if it is comfortable and possibly available online. Three-quarters of them have never sold a garment of their own, while most buy vintage and do so primarily for reasons of convenience.

- Cluster 2: “Fashionistas”: If the brand is unknown, they will hardly buy the garment; for Fashionistas, the important thing is that what they purchase is part of the latest collection and is unique. They have no interest that the garment is comfortable and sustainable. In fact, it is the cluster with the highest share of people who have never bought vintage and have no intention to do so in the near future

- Cluster 3: “The Greens”: For this cluster, quality and durability are essential elements when choosing a garment. It does not matter that the brand is unknown and the garment is “obsolete”; the important thing is that it is comfortable and sustainable. They have the largest share of people who buy vintage (76%) and are the only cluster whose majority has sold a garment at least once. Unlike the Practicals, the reasons that lead them to buy vintage are the sustainability of the choice and the uniqueness of the pieces.

As it emerges from the results of the quantitative analysis, a good part of consumers is increasingly considering the purchase of vintage or second-hand garments, driven by different reasons. In addition, as it emerged from the desk analysis, the growth of the resale market is inevitable and in solid acceleration.

By analyzing and understanding the interests of their consumers, companies in this sector will necessarily consider including resale strategies in their business model, either by implementing their own resale channel or by relying on resale experts.