EV market analysis

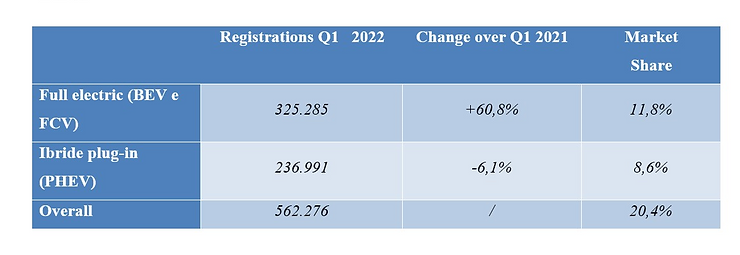

Ever increasingly and real environmental and climate problems led the European Union, in 2019, to approve the Green deal. That is a package of reforms aimed at making Europe environmentally sustainable and achieving climate neutrality by 2050. To achieve this goal, the “Fit for 55” reform package was approved on June 8, 2022. With this package, the European Union aims to reduce greenhouse gas emissions by 55 percent. One of these regulations calls for a 100% reduction in CO2 emissions caused by passenger cars by 2035. Therefore, it will no longer be possible for car manufacturers to produce and market diesel, gasoline, and hybrid (including plug-in) cars. They will otherwise have to aim their research and development funds toward the electric segment. Likewise, all member states will have to invest in a series of support measures for the purchase and use of electric cars, such as the creation of new charging points and incentives for the energy upgrading of buildings in order to install solar panels that can power private charging stations. In particular, Italy is aiming to achieve this through reforms such as the M2 mission of the PNNR. Of this plan, €0.74 billion has been allocated in the development of electric charging infrastructure and the “Superbonus 110%”. The purpose of these measures consists in a series of interventions to upgrade citizens’ homes, including, in favor of sustainable mobility, the installation of photovoltaic systems, storage systems and private charging stations for electric vehicles. Europe has seen a booming electric market in recent years. In 2021, electric BEVs, PHEVs and FCVs sold 1,578,719 units, recording a 105 percent increase over 2020. We find Germany in first place with 478,121 units sold and a 134% growth over the previous year. In second place is the United Kingdom with 212,181 units and a 95% increase. In third place is France with 208,771 sales and an 88% increase. In fourth and fifth place are respectively Norway with 109,139 units and a +62% and Italy with 100,151 units of electric cars with a growth, however, of 236%, much higher than in other European countries. Comparing the first quarter of 2021 and 2022 we note that, in Europe, there was a 60.8% increase in sales of all-electric cars (BEVs and FCVs). This went from 202,350 sales in the first quarter of 2021 to 325,285 in the first quarter of 2022. Currently, full electric cars cover 11.8% of the automotive market share. In contrast, in Q1 of 2022, 236,991 Plug-in Hybrid (PHEV) cars were registered, less than the respective quarter of 2021, suffering a negative change of 6.1%. Market share dropped to 8.6%. Overall, 562,276 cars were sold between BEVs, FCVs and PHEVs covering a market share of 20.4%.

The country with the highest growth in electric car sales this quarter was Romania with +408%, followed by Spain with a 110.3% increase, France with +42.7%, and finally Germany which saw a 29.3% increase.

The Italian market, on the other hand, was the only one in Europe that saw a 14.9% drop in sales: the reason for this was mainly due to delays in eco-incentives.

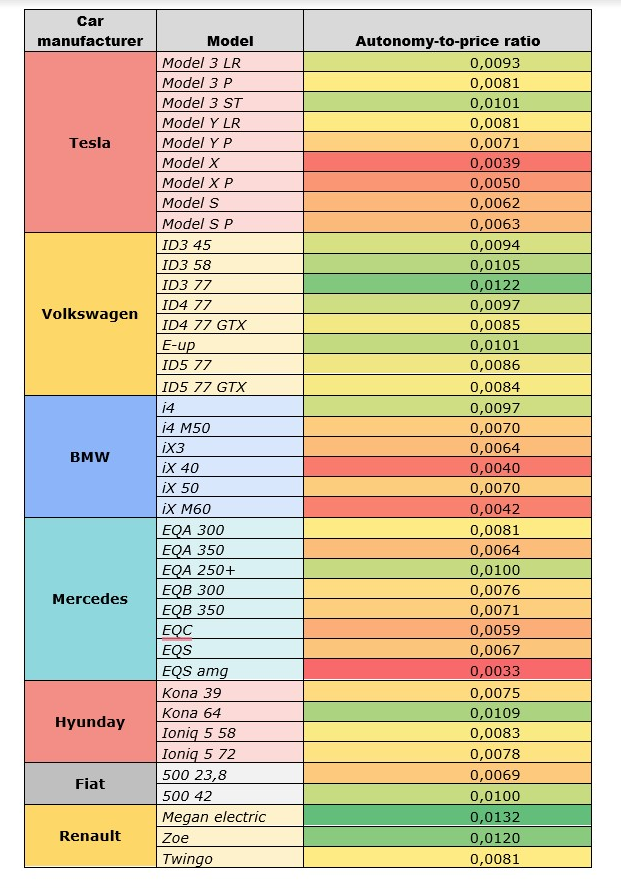

Given that the electric car market has had a very strong expansion and will continue to do so, thanks to the forecasts, we can analyze and compare, through a study, the best-selling full electric segment vehicles in Europe of the major automakers on the market. This study will be carried out considering the two most important variables for a consumer: automony and price. The method consists, first, of calculating the ratio between the autonomy declared by the various automakers, placed in the numerator, and the price of each car, placed in the denominator. Then, by comparing all car models using a color gradient, three different ranges can be identified.

– The first is characterized by the color red, which indicates a very low autonomy-to-price ratio given either by a low autonomy or a very high car price; these elements lead the vehicle to be unaffordable for the consumer from the point of view of these two variables.

– The second range is indicated by the orange-yellow color, which instead indicates an average autonomy-to-price ratio.

– On the other hand, the third and last range is given by the color green; this is where we can find vehicles that have either a very high autonomy or a very low price, making the vehicle affordable by autonomy-price ratio.

The worst cars, in order, are: the Mercedes EQS Amg, the Tesla Model X, and the BMW iX 40, which have autonomy-to-price ratios of 0.0033, 0.0039, and 0.0040, respectively. In contrast, the best vehicles by autonomy-to-price ratio, indicated by the color green, are the Renault Megan electric with a ratio of 0.0132, the Volkswagen ID3 77 kwh with 0.0122 and finally the Renault Zoe with a ratio of 0.0120.

In conclusion, if, until a while ago, the presence of cars powered by electricity alone might have seemed like a futuristic scenario, as of today electric vehicles can be considered a good alternative to gasoline and diesel vehicles. Their success will, anyway, depend on how much countries are willing to invest to enable a transition to an all-electric mobility.