Food shopping online in Italy

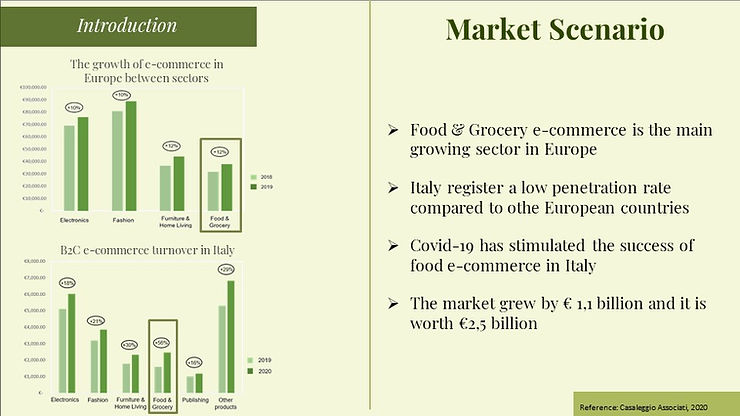

Although online grocery shopping is a relatively new environment and is modest compared to other categories of products, it has experienced a continuous worldwide expansion, estimated at around 21% per year in the period 2014–2019. Particularly, in Europe, among the sectors producing the most it is significant to note the growth of Food & Grocery market. United Kingdom in 2019 was the largest e-commerce market in Europe with a value of around €130 billion, while the countries of Southern Europe, particularly Italy, have been recording the fastest growth. Specifically, the country analyzed in this research was Italy that, despite recording a low penetration rate of 1,1% in 2019, compared to other European countries at 4-8%, recorded a growth of 56% in terms of turnover, reaching € 2,5 billion. Additionally, shopping online in the Agri-Food sector has been one of the most important opportunities created by Covid-19.

This research, made by Camilla Concaro, investigates the reasons pushing consumers to buy food products online and changes following the spread of Covid-19. To do so, 1500 people have been intercepted with a survey that has been analyzed with SPSS.

Most of the sample are married women that are employees and come from Piemonte and Lombardia, between 25 and 44 years old. The 41% of the sample, 622 people, usually buy food products online.

The presence of a secure website, the possibility of receiving shopping at home and the credibility of the platform used were voted as the most relevant factors. Conversely, the presence of attractive advertisements on social media, the ability to pay in cash and the opportunity to collect food in the supermarket are not that important for this sample.

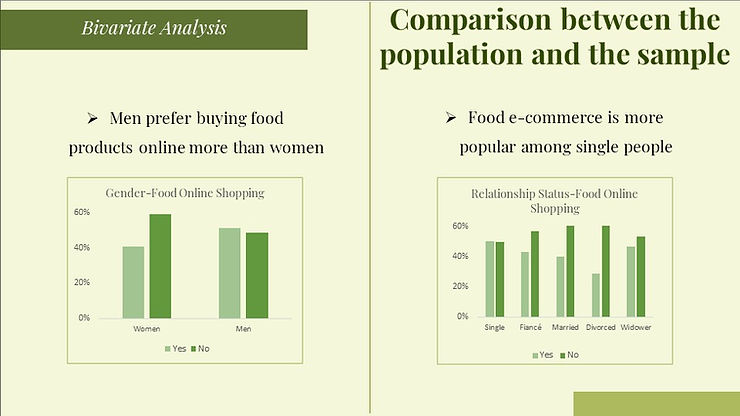

The research highlights that there is a slightly different attitude between men and women: men buy food online more frequently than women (the analysis could be staggered due to a strong non-homogeneity of the sample). As for the relationship status, single people prefer buying food online, while married ones are more prone towards purchasing food offline.

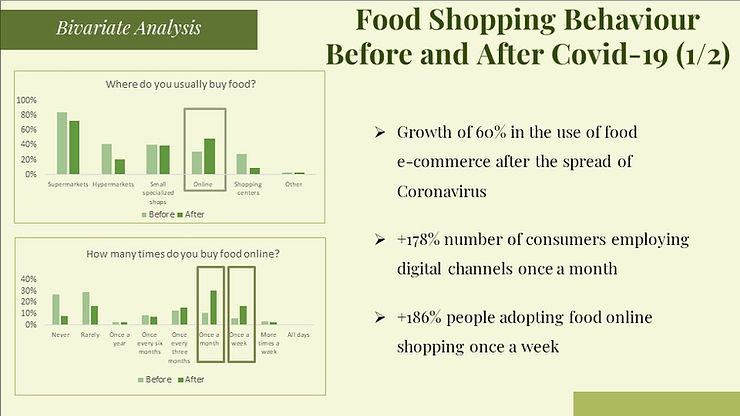

Looking now at consumers’ behavior following the outbreak of the pandemic, the use of the online channel and the frequency of it have seen a significant growth: the first one has gone up by almost 60% and regarding the second one, the number of those shopping food online once a month went up by 178%, as well as that of the ones using food e-commerce once a week, passing from 37 consumers to 106 with a percentage of growth equal to 186%.

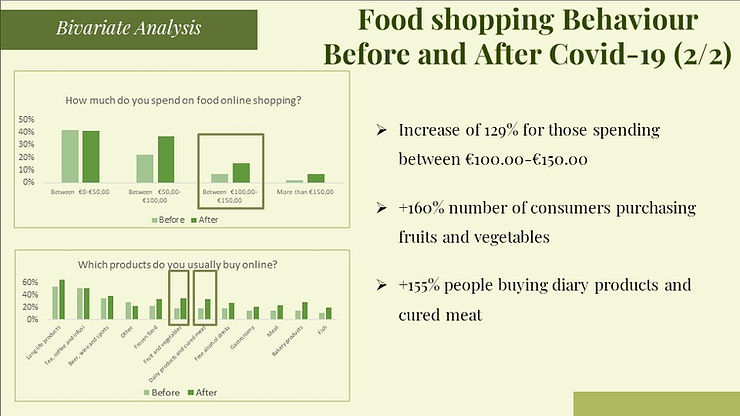

Looking now at the average expenditure on food online shopping, the ones investing between €50 and €100 have increased of 65%, as well as people paying between €100 and €150 (a growth of 129%).

Focusing on the products more purchased online, the number of consumers acquiring fruit and vegetables online has grown by 160%. Similarly, dairy products and cured meat has increased by 155% and a consistent rising has also been recorded by bakery products, fish, and meat.

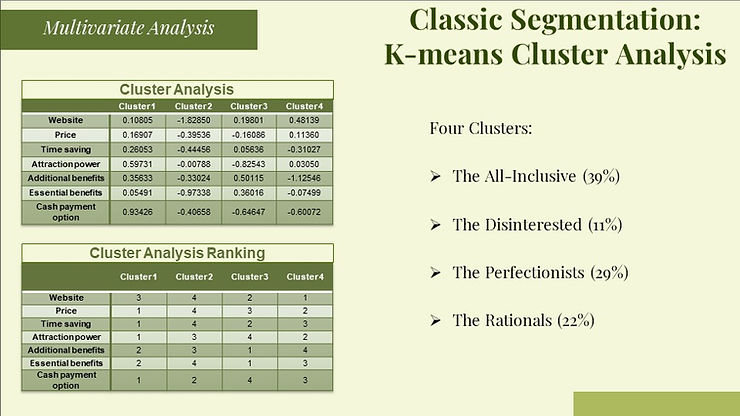

The sample has been divided into clusters of people with similar behaviors. The first one represents 39% of the sample and can be labeled as “The All-Inclusive” as the most relevant items for them to shop online are those of an additional nature, since they do not pay many attention to the “Website” and the “Essential Benefits”.

As for the second cluster, which is composed by the 11% of the target analyzed, there is no particular emphasis on any macro-component, so for these reasons the cluster is recognized with the label “The Disinterested”.

Cluster three represents the 29% of the sample and can be defined as “The Perfectionists”: they research advantages both in terms of effectiveness, in front of the impact of “Additional Benefits” and “Essential Benefits”, both in terms of efficiency given the influence encountered by the “Website”.

Finally, the 22% of the sample is categorized in cluster four, identified as “The Rationals” as the most relevant drivers are the “Website” and the “Price”.

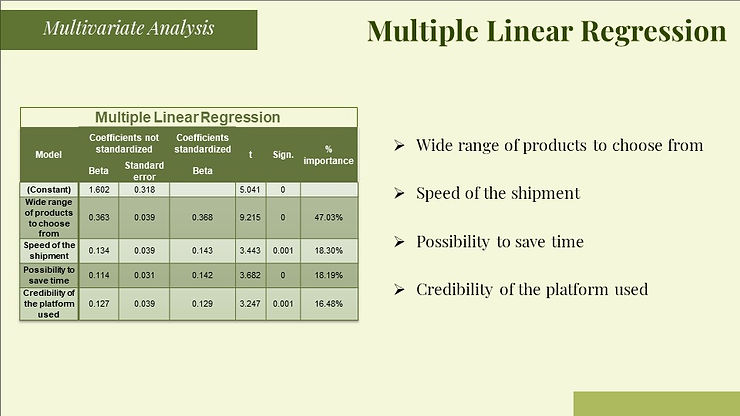

Afterwards, dwelling on the satisfaction of people purchasing food online, it should be emphasized that it depends on four factors, namely the breadth of products to choose from (47%), the speed of the shipment (18.3 %), the possibility of saving time (18.2%) and the credibility of the platform used (16.5%). Specifically, the first element generates an impact of almost 50%, thus pointing out the relevance of having a wide range of products to select.

So, how does the future landscape for consumers who don’t use the digital channel to buy food products online will be?

Specifically, as emerged from the quantitative research the main barrier to the use of food e-commerce, is the inability to see and touch the products, especially the ones belonging to the fresh category.

A solution to limit this obstacle could be the use of virtual reality that, as well as reducing the distinction between offline and online channels, allows a better customer experience and user satisfaction, being a core tool in the field of the omnichannel approach that is affecting Agri-Food market.