A Guide To M&A Premia: an empirical study on bidders’ features on premia paid in the luxury context

Determining the acquisition premium in an M&A transaction has always been complicated due to a high number of factors to be considered, and the effect that rumours and announcements have on the target company’s price before the deal effectively closes.

The following article summarizes the paper I worked on where I investigated the statistical impact of different variables on the premium paid by analysing the last 30-years of M&A transactions worldwide. The analysis is carried across transactions with a deal value > € 10m related to a majority stake investment in a listed company and aims at transforming a highly subjective process as the M&A premium determination into a partial objective process.

The purposes of the thesis are to create a guide to M&A premiums and to provide an alternative valuation methodology in determining the target’s acquisition premium through the creation of a generalised multiple linear regression model that analyses the impact and the statistical significance of deal-specific, target-specific and acquirer-specific variables on the premium paid. Thanks to the predict formula, the software will enable companies with similar characteristics to the data sample considered to insert its specific dependent variables’ values in the model to obtain a range of output premiums that is likely to include the final premium.

The guide will benefit both the bidder and the seller from a strategic point of view. By using the guide, both parties will have the chance to have a clearer understanding of the fairest outcome of the negotiations in determining the premium. From a selling perspective, is the predetermined premium enough to satisfy the selling party? From a buying perspective, will the predetermined price enable the buyer to create long-term value? Or will it destroy the company’s value? Premiums play a vital role in determining whether a transaction will create value or not: from a buyer perspective, for example, it is fundamental that the synergies expected are enough to justify the premium paid. In particular, there are some analytical tools that are very helpful in supporting decisions making: managers can use data analytics to estimate the relationship between the variables of interest. For example, after considering the relationship between the premium paid and the percentage of shares owned after a transaction, a manager might predict the acquisition premium for any given level of shares held post-transaction. In addition to that, from a selling perspective, the guide will help the seller better understand the most critical factors that significantly impact the premium and that the company should focus on, assuming a future sale.

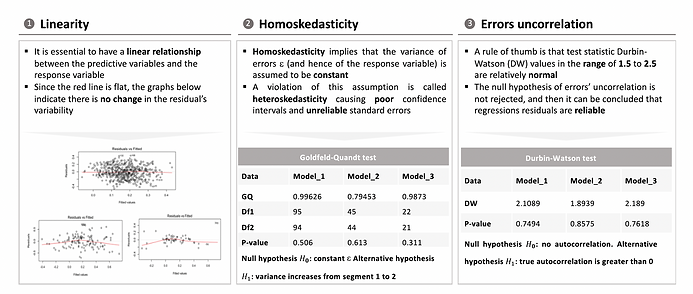

In particular, the article will analyse the impact of control premium (Model_1) and the internationalisation (Model_2) variables separately. These two variables have not been investigated yet by the past literature but play a crucial role in determining the premium. Finally, Model_1 (including all industries) will be compared to the third and last model of the thesis (Model_3) regarding the luxury industry to analyse differences and common points.

Specifically, the study seeks to answer the following research questions:

- How much and in which direction do different categories of variables impact the premium in an M&A transaction?

- What is the statistical impact of control premium on the premium paid?

- What is the statistical impact of internationalisation on the premium paid?

- Is the final model built valid in the luxury context?

The study will answer these research questions by first analysing M&A premiums from a theoretical point of view and secondly will build statistical models to draw the necessary conclusions on the subject.

The paper starts with the literature and theoretical framework analysis about the topic.

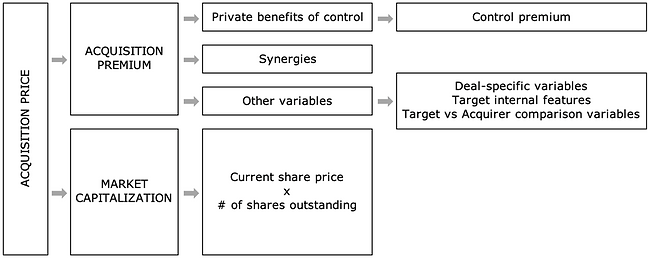

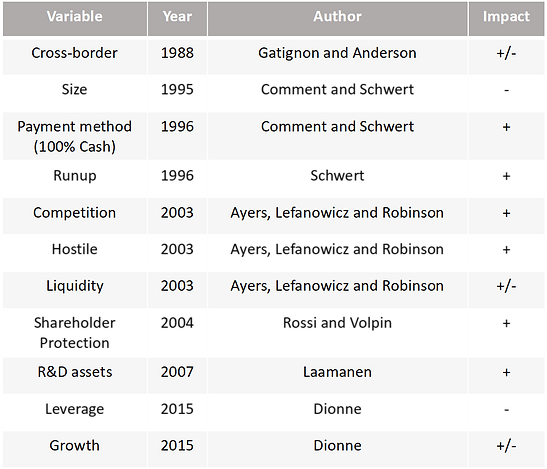

Whenever there is the chance to acquire a company’s majority stake, and therefore the opportunity to control and manage the firm, then the determination of the acquisition price has to consider the control premium, which increases the deal’s price. Synergies and control premium are two concepts very different from each other: the former represents the revenues increase or the costs reduction thanks to the business combination of two entities that were standing alone before; the latter, instead, measures the value the buyer is willing to pay to obtain the right to take company’s decisions that will affect the business of the target company such as making acquisition investments, managing and optimizing the firm from a strategic, operating and financial standpoint. In particular, the control gives the major shareholder the right to approve financial statements, appoint and dismiss administrators and set salaries and bonuses to its employees. The impact of other variables impacting the premium is instead summarized in the following table:

The acquisition price is usually determined through the primary valuation methodologies used by financial advisors to evaluate a company, such as trading comparable, discounted cash flow (DCF) and precedent transaction analysis. However, even if these methodologies are very useful in understanding a possible bid price range, it is essential to say that many other factors are influencing the price, such as:

- Market liquidity.

- Interest rates trend.

- Sale process’s competition: is it a restricted approach that is fast and confidential but reduces the chances of maximizing the price? Or is it an open process with a lower level of confidentiality but a higher chance to get an attractive offer due to the intense competition?

- The due diligence carried out by the bidder.

- Provisions and warranties like the earn-out clause, the reverse earn-out, the “key-people”, the MAC (Material Adverse Change) Clause.

Very often, these factors are difficult to be factored by the most common valuation methodologies when evaluating a company.

In the last 30 years of M&A activity, the empirical evidence shows that premiums paid undergo significant fluctuations confirming how varied and complex the determinants impacting the premium can be. In particular, it has been determined how premium trends are not directly linked to main macroeconomic events such as the great financial crisis (2008) while premiums are instead linked to the region where the target company is headquartered and the business where the target company operates.

The luxury sector was chosen to be tested against the general model which included all the industries. Luxury is heritage, craftmanship, status, exclusivity, personalization, uniqueness, impeccable customer service and experience. Luxury brands must first encode social distinction with products that cannot simply be expensive; they must be exclusive and distinctive. Hedonism takes precedence over functionality, and luxury has to be multi-sensory and experiential. According to Bain & Co., due to the Covid-19 crisis, the global luxury market contracted to € 1 trillion value, down 20% to 22% from 2019. In particular, the lack of tourism, lockdowns, stores closures and low consumer confidence negatively impacted the European region, which recorded its market share reduction in the luxury sector from 31% to 26%. The industry is also undergoing a consolidation trend with big players such as LVMH and Kering (for the fashion luxury segment) strengthening their market position by acquiring another minor Maison. In fact, in 2020, 59% of deals accounted for small-sized companies with sales lower than $ 51m, confirming the consolidation trend with smaller companies. Despite the crisis, the luxury industry has been growing a lot in the last few years, and it is supposed to continue growing, fueling the attractiveness of financial investors as private equity.

Let’s now move to the empirical study of the paper.

To build a comprehensive dataset, I used two databases: SDC Platinum was used to gather data regarding the M&A transactions and the deal-specific variables characterizing every deal; Thompson Reuters Datastream has been used to collect internal key performance indicators and financial data of the target company and the acquirer, necessary for comparing the parties.

Furthermore, R-Commander was used to test the research hypothesis, develop multiple linear regression models and analyze the results obtained.

The analysis starts with the data collection of M&A transactions that have the following characteristics:

- Deal value > € 10m.

- Majority stake acquisition.

- Transaction status: completed.

- Acquirer and target are listed firms.

- Date announced: 01/01/1990 to 01/01/2021.

- Regions: worldwide.

- All sectors.

- Payment methods: 100% stock or 100% cash only.

- Domestic and cross-border deals.

- Excluded financial sponsors acquirers (mainly private equity).

After applying these filters mentioned above when downloading data from SDC Platinum, a sample of 3,492 transactions has been identified. Later, the sample of data was matched to Datastream to gather specific data of the acquirer and the target. Here, after selecting only those transactions that had complete data for the analysis, the sample was reduced to 936 transactions. Finally, with the help of R-Commander, the data sample has been cleared for outliers, not to distort the model.

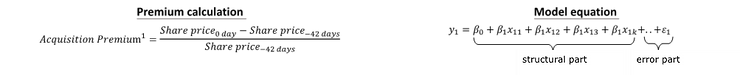

After that, I was able to build 3 regression models. In all models analyzed, the dependent predicted variable (y) is the response variable of the model, which is the premium of the transaction. The independent variables (x) used to predict the value of the Premium are instead the predictors of the model that are classified into three main categories: Deal-specific variables, Target internal features variables, Target vs Acquirer comparison variable, including dummy variables.

Model_1 is made of 621 observations. The model will be used to create the guide to M&A premia and analyze the impact of different variables on the acquisition premium. Secondly, the model will focus on control premium and test if there is a link between a poorly managed company and a higher acquisition premium by introducing two variables comparing the Earning-per-Share (EPS_growth_A_vs_T) and the Earnings Before Interests, Tax, Depreciation & Amortization (EBITDA_growth_A_vs_T) growth of the acquirer and the target.

Model_2 is made of 128 observations and will test the internationalization variable. Internationalization is a dummy variable with value 1 if the internationalization level of the acquirer is higher than the target; value 0 otherwise. This analysis aims to investigate if having a good export is repaid when a company is subject to an M&A transaction. In other words, if the premium reflects a component that depends on the percentage of foreign sales on the total sales.

Model_3 is made of 54 observations only including target companies operating in the luxury industry. The goal will be to analyze the differences and common points between the two models in terms of coefficients direction, significance and adjusted R-squared.

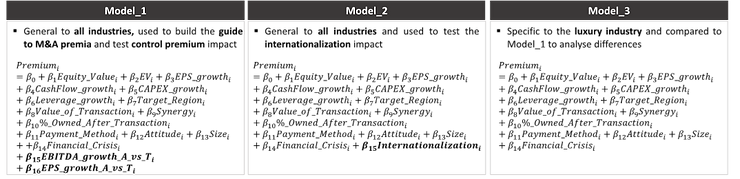

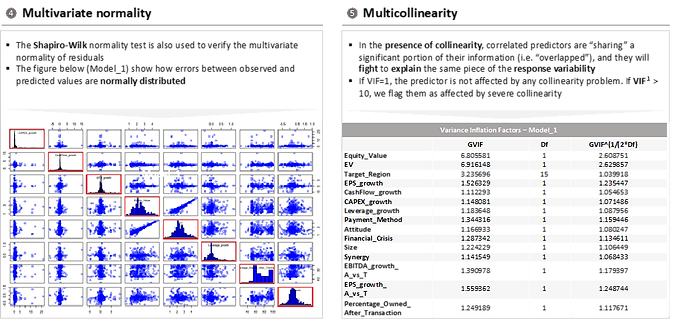

Every time you deal with numbers, it is important that these numbers are reliable enough. This is why I decided to test the three models to five main assumptions: linearity, homoskedasticity, errors uncorrelation, multivariate normality and multicollinearity.

It can be concluded that all the hypotheses at the basis of the model OLS have been respected and that the study results can now be presented and analyzed.

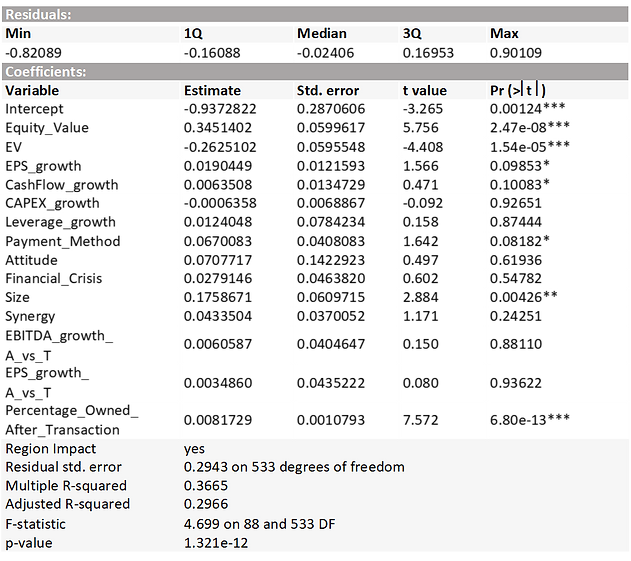

Model_1:

By analysing the results, it is possible to make the following conclusions:

-

There is a positive linear statistically significant relationship between Premium and Equity_Value, EPS_growth, Payment_Method, Size, CashFlow_growth and Percentage_Owned_After_Transaction. A one unit increase of the predictor brings to an increase of the average acquisition premium by the coefficient’s value. For example:

Ø Cash payment includes a tax effect that benefits the acquirer and cash is cheaper than stock, increasing the premium.

Ø Growing positive cash flows is highly valued by investors because it is a good measure of long-term future outlook and strength of the company.

-

There is a negative linear statistically significant relationship between Premium and EV. The negative correlation can be justified by the fact that an increase in the net debt (debt – cash & cash equivalents) increases the debt of the company and reduces its attractiveness, resulting in a lower acquisition premium.

-

P-values of EBITDA_growth_A_vs_T and EPS_growth_A_vs_T are high and therefore not statistically significant. It is not possible to make strategic conclusions about the impact of control premium on the acquisition premium. Therefore, it would be better to remove these variables to increase the model precision.

-

The R-squared is 36.65%, and the adjusted R-squared is 29.66%.

-

The model is valid for the population portion that have similar features to the firms of the data sample. The following steps can be used to estimate premium:

-

PremiumRange <- data.frame (…)

-

Predict (object = Model_1, newdata = PremiumRange, interval = “prediction”, level = 0.95)

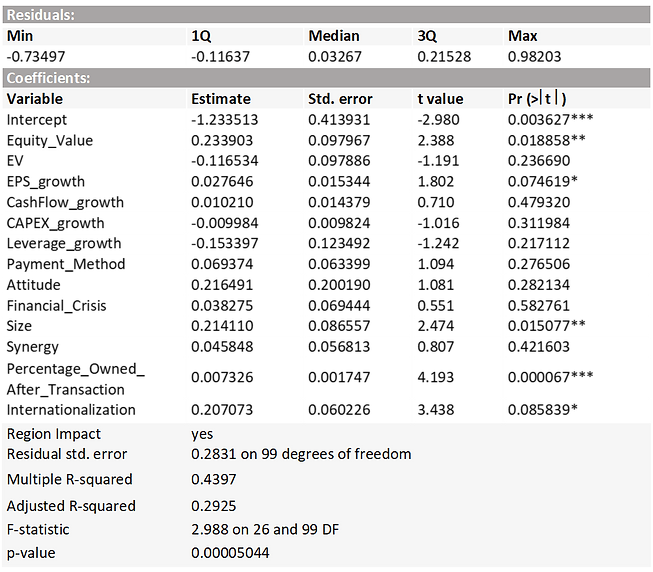

Model_2:

The coefficient interpretation is the following: anytime the internationalization variable is equal to 1, and therefore

then, the average acquisition premium increases by 0.207073.

The explanation of this positive effect is connected to the idea of geographical synergies that can be experienced when the target company is not as much internationalized as the acquirer.

Assuming the buyer has strong distribution networks worldwide, the selling company will gain access to this network and be able to sell its product through it. Consequently, cost synergies can be experienced because the new combined entity will sell a higher number of products by using the same current distribution networks. In addition to that, the new entity will renegotiate terms with suppliers thanks to a higher bargaining power. In the case outlined, the buyer will be willing to pay a higher acquisition price because it will be able to experience more distribution and cost synergies, given the low internationalization level of the target company acquired.

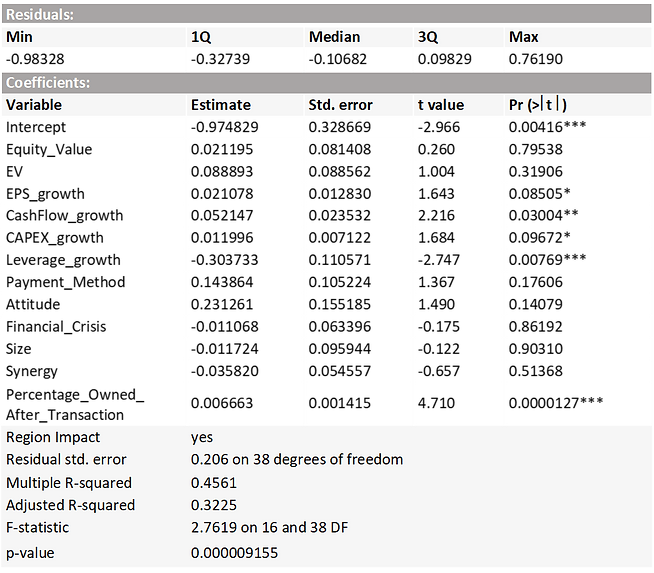

Model_3:

-

For Model_3, the average premium is 25.7%, higher compared to the average premium of 23.3% of Model_1

-

The difference is explained by the role of the brand which is what enable a luxury company to charge a premium and a higher price for their products compared to brands that offer products with the same tangible functions.

-

The same reasoning can be applied to the acquisition price in a transaction: whether the buyer recognize the superiority of the brand and the seller is able to market its brand superbly, then the buyer might recognize a portion of premium attributable to the intangible value of the brand.

-

Differences from Model_1:

-

CAPEX is positively associated with premium, especially after the Covid-19 crisis and the disruption of digitalization, companies are asked to invest money in new technologies such as CRM systems or in the omnichannel.

-

Leverage variable negatively impacts the premium: too much debt can lead to credit downgrades, discouraging investors and resulting in a lower acquisition premium.

-

Similarities with Model_1:

-

Cash flows from operations is statistically significant and positively correlated with premium.

-

The growth of EPS is also positively associated with acquisition premium.

-

The percentage of shares owned after the transaction increases the premium.

The final goal of the guide to M&A premium was to transform a highly subjective process as the M&A premium determination into a partial objective process. “Partial” is the keyword: I would say it is very challenging and almost impossible to create an accurate model able to explain all M&A premiums paid in the last 30 years. As for this paper’s goal, the thesis could only partially explain some of the main effects on the acquisition premium. Many other objective variables such as the market liquidity, the interest rate trends, the sale’s process competition or the provisions and warranties like the earn-out clause play a crucial role in the negotiation process of the acquisition premium and must be considered in the analysis; however, the lack of information regarding these variables set another critical limit of the research.

In addition to that, there are two crucial limits of the research: the subjective negotiation skill, which is difficult to generalise and the different buyer and seller perspectives. For example, a company is generating low and negative cash flows: the buyer might argue the company is financially unstable, the business is spending more money than it is making and therefore negotiate for a lower price and a lower premium for the company. On the other hand, the seller can argue that it is positioning the company for future growth, that it has already invested a lot in CAPEX, and therefore the acquirer will not need to make further investments. In this way, the seller might ask for a higher premium for the effort and the investment made. But, then, will the ROI be enough to justify the premium paid? Who knows. Acquirers are not magicians and many times, making an acquisition is very risky, especially if there is no Post-Merger Integration business plan to implement synergies and prevent a clash of cultures.