Time Series Forecasting forPredicting Luxury Watch Prices

BUSINESS NEED

A luxury watch start-up wanted a deeper understanding of the market. To address this, Analytics Arts developed a forecasting model for precise price predictions, ultimately enhancing decision-making. Additionally, the project included financial simulations to evaluate funding scenarios and their impact on profitability.

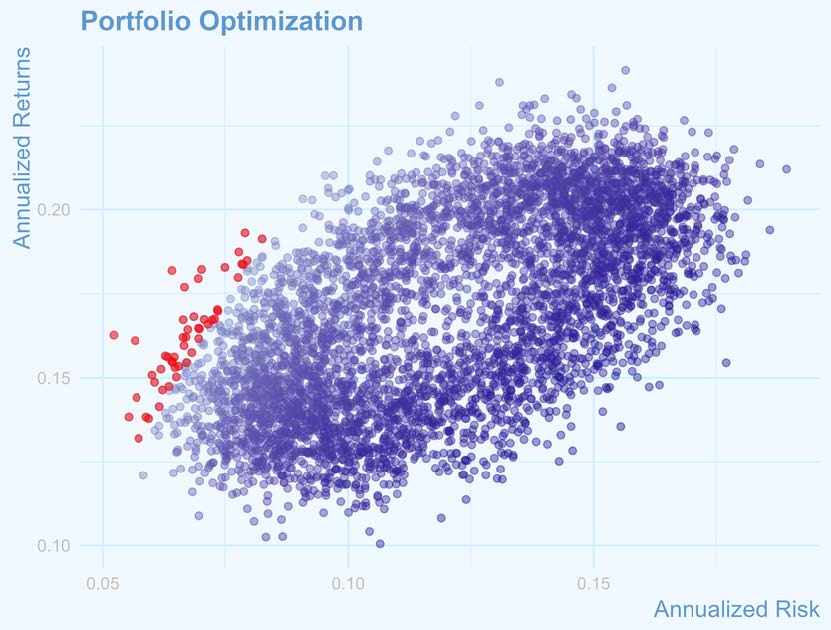

METHODOLOGY

We implemented a time series forecasting solution combining traditional statistical methods and advanced machine learning models. After collecting and processing historical price data from a popular luxury watch marketplace, we identified trends, seasonality, and anomalies. We validated various models, including classical decomposition, exponential smoothing, autoregressive models, Random Forest, Prophet, and Neural Networks. The best forecasts came from an ensemble of these methods. Each model was validated using performance metrics and expert feedback, prioritizing realistic prediction over purely accurate ones.

OUTPUT

We included a Monte Carlo simulation model to estimate the start-up’s operational returns based on predicted prices. This solution improved price predictions, reducing arbitrary choices and providing precise forecasts. It enabled better anticipation of price movements, supporting informed purchasing and investment decisions. The start-up benefited from realistic price projections, minimizing the risk of overpaying or underselling watches.